What Fees Should I Pay When Buying a Used Car: A Complete Guide

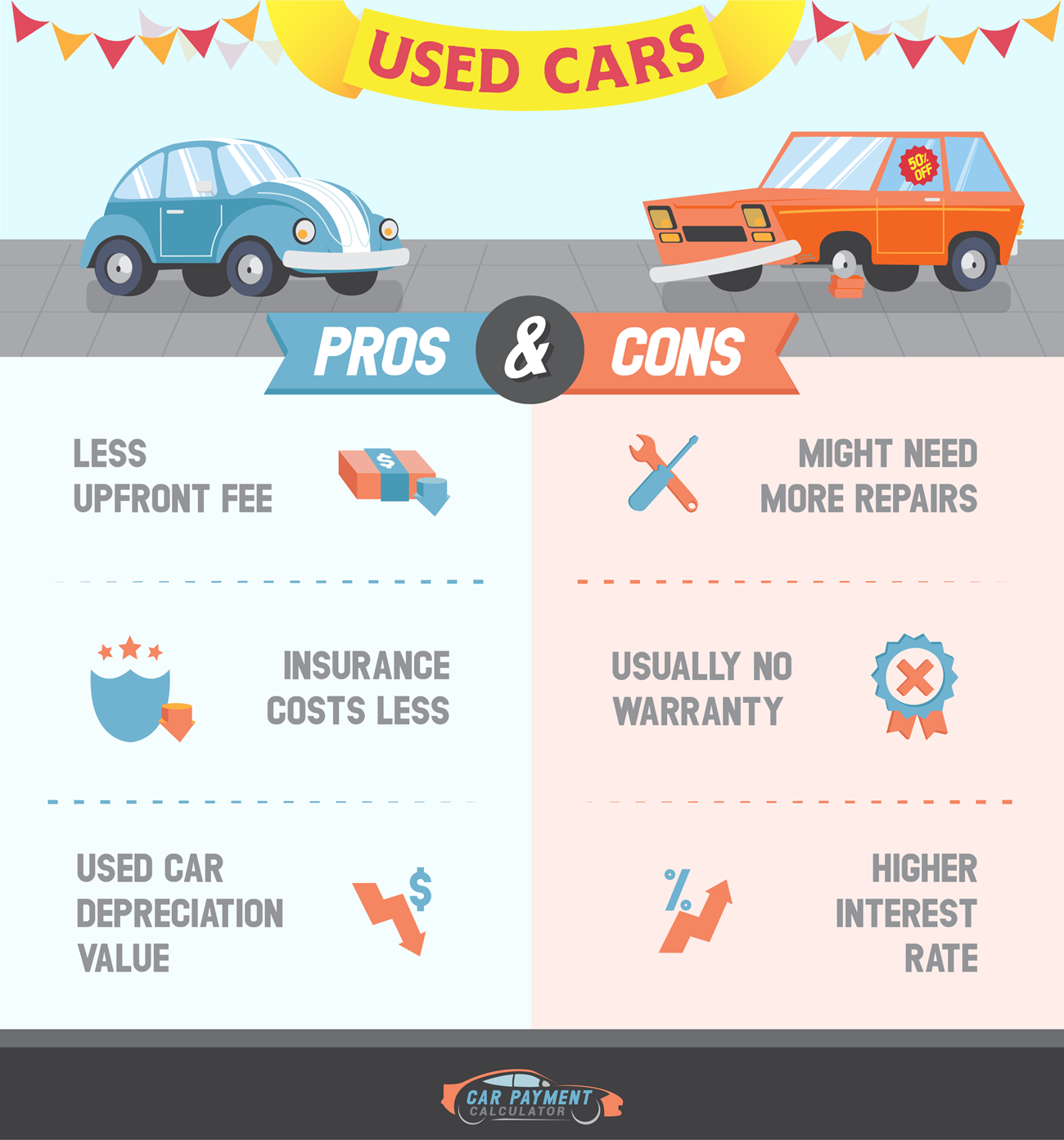

Hey there! Thinking about buying a used car? It’s not just about the price tag. There are a lot of extra costs that can sneak up on you.

When you’re buying a used car, it’s crucial to know all the costs involved. These fees can add up quickly and impact your budget. We’re talking about things like sales tax and registration. Each fee has a role in the buying process. Knowing these costs helps you prepare and avoid surprises.

Initial Costs

Buying a used car can save you a lot of money. But many people don’t realize the extra fees involved. It’s important to know the initial costs when planning your budget.

Purchase Price

The purchase price is the biggest cost when buying a used car. This price depends on the car’s make, model, year, and condition. You can often negotiate this price with the seller.

Here are some key factors that affect the purchase price:

- Mileage

- Vehicle history

- Car’s age

- Market demand

Be sure to research and compare prices from different sellers. This helps in getting a good deal.

Here’s a quick look at what you might find in the market:

| Car Model | Year | Price Range |

|---|---|---|

| Toyota Corolla | 2015 | $10,000 – $15,000 |

| Honda Civic | 2016 | $12,000 – $18,000 |

| Ford Fusion | 2014 | $8,000 – $14,000 |

Remember, negotiating the price can help you save more. Always check the car’s condition and service history before finalizing the deal.

Credit: pomcar.com

Sales Tax

Sales tax is another cost to consider. This tax is based on the car’s purchase price and varies by state.

Here’s a simple breakdown:

| State | Sales Tax Rate |

|---|---|

| California | 7.25% |

| Texas | 6.25% |

| Florida | 6.00% |

To calculate the sales tax, multiply the purchase price by the tax rate. For example, if you buy a car for $10,000 in California, the sales tax would be $725.

Besides the purchase price and sales tax, other fees might include:

- Vehicle registration fees

- Title transfer fees

- Dealer fees

- Inspection fees

- Financing charges

- Insurance premiums

- Documentation fees

- Maintenance costs

It’s wise to account for these when setting your budget.

Financing Fees

Buying a used car can be a smart choice. It saves money compared to a new car. Yet, there are many fees to consider. One key part is financing fees. These fees can add to your used car purchase costs.

Loan Origination Fees

When you take out a loan to buy a used car, lenders often charge loan origination fees. These fees cover the cost of processing your loan application. Loan origination fees can vary from lender to lender. Some common components include:

- Application fees: Fees for applying for the loan.

- Processing fees: Costs for processing the loan paperwork.

- Underwriting fees: Fees for evaluating your creditworthiness.

These fees can range from 1% to 3% of the loan amount. For example, a $10,000 loan might have $100 to $300 in loan origination fees. Make sure to ask your lender for a clear breakdown of these fees.

Comparing fees from different lenders can help you save money. It’s important to consider these fees when calculating your total financing charges. Always read the fine print to understand all costs involved.

Interest Rates

Interest rates are a significant part of financing charges. The interest rate on your loan affects your monthly payments and the total amount you will pay over the life of the loan. Factors that influence interest rates include:

- Credit Score: Higher scores often get lower rates.

- Loan Term: Shorter terms usually have lower rates.

- Down Payment: Larger down payments can reduce rates.

It’s crucial to shop around for the best interest rates. Even a small difference in rates can save you a lot of money. For example, a 1% difference on a $10,000 loan over five years can save you hundreds of dollars. Always check the annual percentage rate (APR), as it includes both the interest rate and any fees.

Remember, the total cost of your loan is not just the interest rate. It’s also the fees associated with the loan. Understanding these can help you make a better decision and manage your used car purchase costs effectively.

Inspection Fees

When buying a used car, several fees come into play. One of these important fees is the inspection fee. This fee ensures that the car is in good condition. It also helps you avoid future issues. Understanding these fees can save you money and stress.

Pre-purchase Inspection

Before buying a used car, a pre-purchase inspection is essential. This inspection checks the car’s overall condition. It helps you know if the car is a good deal.

During this inspection, a mechanic will look at:

- Engine and transmission

- Brakes and tires

- Suspension and steering

- Electrical systems

- Body and frame

The cost of a pre-purchase inspection varies. It usually ranges from $100 to $200. This fee can save you from buying a car with hidden problems. Always choose a trusted mechanic for this task.

Here is a simple table to show the potential cost of a pre-purchase inspection:

| Inspection Type | Estimated Cost |

|---|---|

| Basic Inspection | $100 |

| Detailed Inspection | $200 |

Emissions Testing

Another important fee is the emissions testing fee. This test checks if the car meets environmental standards. Many states require this test to reduce air pollution.

Emissions testing checks the car’s exhaust system. It ensures the car is not releasing too many pollutants. The test usually costs between $30 and $90. The price can vary depending on your location and the car’s make and model.

Here are some benefits of emissions testing:

- Protects the environment

- Ensures the car runs efficiently

- Helps avoid fines

Emissions testing is a small but important fee. It helps keep our air clean and your car running well. Ensure your used car passes this test before making a purchase.

Registration Fees

Purchasing a used car involves several fees that buyers must consider. Understanding these costs can help avoid surprises later. One of the primary expenses is the vehicle registration cost. This fee is necessary for legally driving the car. Let’s explore the used car purchase fees in more detail, focusing on title transfer fees and the cost of license plates.

Title Transfer

When you buy a used car, title transfer fees are mandatory. This fee ensures that the vehicle’s ownership is legally transferred to you. Without this, you can’t claim ownership. The cost of the title transfer varies by state. It can range from $15 to $150.

Here are some points to consider:

- State-specific car fees: Different states have different rates.

- Sales tax on used cars: Some states may include sales tax in title transfer fees.

- Documentation fees: Dealerships might charge extra for handling the paperwork.

In some cases, the dealer may handle the title transfer for you. This service often includes an additional fee. It’s important to confirm all costs upfront to avoid unexpected expenses.

License Plates

Getting a new car means you need new license plates. This is another car buying additional expense. The cost depends on the state and sometimes the type of car. In general, license plate fees can range from $20 to $200.

Consider these factors:

- State-specific car fees: Each state has different fees for license plates.

- Dealership fees for used cars: Some dealers include this in their service package.

- Vehicle registration costs: This is often combined with license plate fees.

In addition to the basic fee, some states charge extra for personalized plates. Always check with your local DMV to get the most accurate fee structure. Being prepared helps you manage your used car purchase fees better.

Insurance Costs

Buying a used car involves various expenses. These include vehicle registration fees, sales tax on used cars, and dealership fees. One significant expense is insurance costs. Understanding these costs helps you budget better. Below, we discuss the key aspects of insurance costs: premium rates and coverage options.

Premium Rates

Insurance premiums are one of the major costs when buying a used car. Several factors affect these rates. Knowing these can help you save money.

Factors that affect premium rates:

- Age of the car: Older cars usually have lower premiums.

- Car model: Luxury models have higher insurance costs.

- Driver’s age and driving history: Young or inexperienced drivers pay more.

- Location: Living in urban areas may increase your premium rates.

Comparing quotes from different insurance providers is wise. This helps find the best rates. Some companies offer discounts for safe driving or bundling policies. Always ask about available discounts.

Here’s a simple table to illustrate possible premium rates:

| Car Age | Monthly Premium |

|---|---|

| 1-3 years | $100 – $150 |

| 4-6 years | $70 – $120 |

| 7+ years | $50 – $100 |

Coverage Options

Choosing the right coverage options is crucial. This protects you from unexpected costs.

Common coverage options:

- Liability coverage: Covers damages to others if you’re at fault.

- Collision coverage: Covers damages to your car in an accident.

- Comprehensive coverage: Covers non-collision-related damages.

- Uninsured/underinsured motorist coverage: Protects if the other driver lacks insurance.

- Medical payments coverage: Covers medical expenses for you and passengers.

It’s important to assess your needs. Liability coverage is usually mandatory. Adding collision and comprehensive coverage can be beneficial. Especially for newer used cars. Uninsured motorist coverage is also wise. It protects you from others’ negligence.

Always read the policy details carefully. Understand what each coverage includes. Ask questions if needed. This ensures you get the best protection for your money.

Dealer Fees

Buying a used car can be exciting but also confusing. Many fees come with a used car purchase. Understanding these fees helps to avoid surprises. Here, we discuss common dealer fees you might encounter.

Documentation Fees

Documentation fees cover the cost of paperwork. Dealers charge for preparing the sale documents. These fees vary by state and dealership.

Important things to know about documentation fees:

- Average cost: $50 to $500.

- State regulations: Some states cap the fee.

- Non-negotiable: Usually, you must pay this fee.

Documentation fees may include:

- Vehicle Registration Fees: Register the car in your name.

- Title Transfer Fees: Transfer the car title to you.

- Sales Tax on Used Cars: Pay the required state tax.

- Inspection Fees for Used Cars: Ensure the car meets state standards.

Dealer Add-ons

Dealer add-ons are extra features or services. These are offered by the dealer at the time of purchase. They can increase the overall cost of the car.

Common dealer add-ons include:

- Extended warranties: Cover repairs beyond the basic warranty.

- Financing charges for used cars: Fees for arranging a loan.

- Warranty costs for used cars: Additional protection plans.

- Insurance premiums for used cars: Optional insurance packages.

Before accepting any add-ons, consider:

- Need: Do you really need this feature?

- Cost: Is it worth the extra money?

- Alternatives: Can you get it cheaper elsewhere?

Always review all dealer add-ons carefully. Some may be useful, but others could be unnecessary.

Maintenance And Repairs

Buying a used car can be a smart choice. It’s often cheaper than a new car. But there are hidden car fees you should know. These include maintenance and repairs. Understanding these costs will help you budget better and avoid surprises.

Immediate Repairs

When you buy a used car, some repairs might be needed right away. Immediate repairs can include fixing brakes, replacing tires, or addressing engine issues. These automotive repair costs can add up quickly.

Let’s look at some common immediate repairs:

- Brake repair: $150 – $300

- Tire replacement: $400 – $800 for a set

- Engine repairs: $500 – $1500

These prices can vary based on the car’s model and age. It’s crucial to get a pre-purchase inspection. This helps identify any major issues before buying. Consider these car buying expenses in your budget.

Routine Maintenance

After immediate repairs, think about routine maintenance. This keeps your car in good shape. Regular check-ups can prevent bigger problems. Common used car maintenance tasks include oil changes, filter replacements, and tire rotations.

Here are some typical costs:

| Maintenance Task | Cost |

|---|---|

| Oil Change | $30 – $60 |

| Filter Replacement | $20 – $50 |

| Tire Rotation | $20 – $50 |

Routine maintenance can save money in the long run. It extends the life of your car. Plan for these car buying expenses as part of your overall budget. Regular maintenance reduces the need for costly repairs.

Hidden Fees

When buying a used car, it’s important to be aware of the various fees that can add to the cost. Many buyers focus on the sticker price but forget about the hidden fees. These hidden costs can quickly add up. This guide will help you understand the different fees involved in a used car purchase. Knowing these costs will help you make an informed decision.

Extended Warranties

Extended warranty options are common in used car purchases. These warranties cover repairs after the manufacturer’s warranty expires. They offer peace of mind but come at a cost. Here are some key points about extended warranties:

- Cost: Extended warranties can cost between $1,000 and $3,000.

- Coverage: They cover major parts like the engine and transmission.

- Duration: These warranties last from one to five years.

It’s important to read the fine print. Some warranties only cover specific repairs. Others might require you to use certain repair shops. Ask questions to understand what the warranty includes. This will help you decide if it’s worth the extra cost.

Add-on Products

Add-on services for used cars can also increase the total cost. These products range from extra features to protective measures. Common add-ons include:

- Gap Insurance: Covers the difference between the car’s value and the loan balance.

- Paint Protection: Protects the car’s paint from scratches and fading.

- Rust Proofing: Prevents rust on the car’s body.

- Window Tinting: Adds a tint to the windows for better privacy.

Each of these add-on products has its own cost. For example, gap insurance can add $500 to $700 to your expenses. Paint protection and rust proofing can cost between $200 and $1,000 each. Always consider if you really need these add-ons. They can make your used car purchase more expensive.

Credit: www.carpaymentcalculator.net

Frequently Asked Questions

What Are Common Fees When Buying A Used Car?

Common fees include sales tax, registration, and title fees. You might also encounter dealership fees, inspection fees, and documentation fees. Always ask for a detailed breakdown.

Do I Need To Pay Sales Tax On A Used Car?

Yes, sales tax is typically required when purchasing a used car. The rate depends on your state. Check your local regulations for accurate information.

What Is A Documentation Fee?

A documentation fee covers the cost of processing paperwork for your car purchase. It varies by dealership. Always ask for the exact amount before agreeing.

Are There Hidden Fees In Used Car Purchases?

Hidden fees can include dealer add-ons and extended warranties. Always review the contract thoroughly. Ask for a breakdown of all fees to avoid surprises.

Conclusion

Understanding the fees involved in buying a used car is crucial. It helps avoid surprises and budget better. Always check registration, taxes, and dealer fees. Also, factor in insurance costs and any inspection fees. Researching these costs saves money and ensures a smooth purchase.

Plan well, and you can enjoy your new car worry-free. Happy car shopping!